IRS

Gregory J. Cook, EA, CPA

October 20, 2016

Arab, Alabama

Electronic Mail or email, has been a hot topic recently. Hillary Clinton, John Podesta, Wikileaks! We rely on email heavily to carry out our day to day mission at the office. I manage my own mail server in our data center. Perhaps once or twice per year, I rely on a Microsoft Certified IT Consultant for assistance. My consultant has encouraged me on occassion to reduce my cost associated with maintaining my own mail server by as much as 80% by switching to a subscription service like Office 365 or Exchange Online.

I have always dismissed the notion of a subscription service rather than maintaining the hardware and software in house. First, I don't want our email traffic passing through a thrid party and secondly, I certainly don't want our email residing on someone elses server somewhere. Also, we encrypt our email.

I am Required to Archive Emails but the IRS is Not

The IRS currently maintains an on-premises e-mail environment that does not have archive capability. The existing system hardware is approaching manufacturer end-of-support and is experiencing numerous failures resulting in a significantly increased workload on enterprise e-mail support staff. If the IRS does not efficiently upgrade its e-mail environment, it could adversely affect the IRS’s ability to effectively perform tax administration.

The IRS purchased subscriptions for an enterprise e-mail system that, as it turned out, it could not use. The purchase was made without first determining project infrastructure needs, integration requirements, business requirements, security and portal bandwidth, and whether the subscriptions were technologically feasible on the IRS enterprise.

IRS Spends $12 Million on Software Subscriptions it Never Deployed

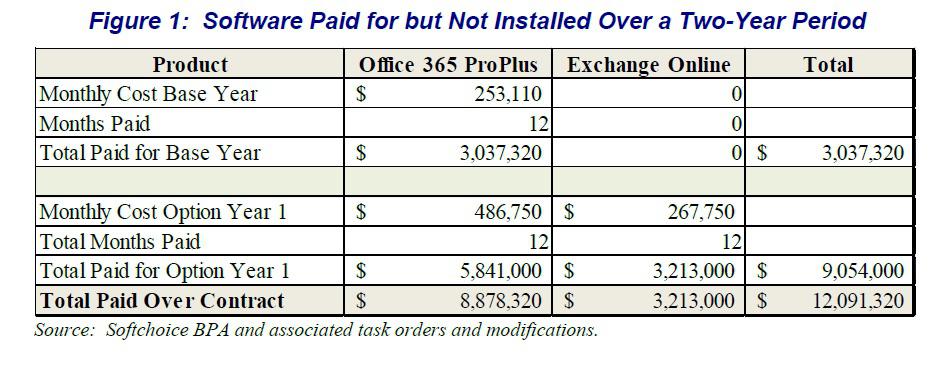

IRS Information Technology organization executives made a management decision to consider the enterprise e-mail project an upgrade to existing software and not a new development project or program. Therefore, the Information Technology organization did not follow the Internal Revenue Manual Enterprise Life Cycle guidance. The IRS authorized the $12 million purchase of subscriptions over a two-year period between June 2014 and June 2016. However, the software to be used via the purchased subscriptions was never deployed.

According to the Inspector General for Tax Administration (TIGTA), "the IRS may have violated the bona fide needs rule when it purchased the subscriptions using Fiscal Years 2014 and 2015 appropriations and did not deploy the software subscriptions in those years. In addition, the IRS violated Federal Acquisition Regulation requirements by not using full and open competition to purchase these subscriptions."

TIGTA recommended that the Chief Information Officer ensure that 1) appropriate Internal Revenue Manual sections are followed prior to the subscription requisition process and throughout the subscription project development life cycle for new subscriptions or managed services procurements and 2) a review is conducted by IRS Chief Counsel to determine if the subscriptions purchased violated the bona fide needs rule and take any actions required by law.

TIGTA also recommended that the Chief Information Officer and Chief Procurement Officer ensure that, if the IRS intends to purchase a cloud solution in the future, it acquires the products through competitive procedures outlined in the Federal Acquisition Regulation.

Greg Cook is an Enrolled Agent, licensed by the U.S. Treasury Department to represent taxpayers before all administrative levels of the Internal Revenue Service (IRS). He is also a Certified Public Accountant licensed by the states of Alabama and Tennessee.